WuXi XDC Delivers 62% Revenue Growth and Record Project Momentum in H1 2025

19 August 2025 | Tuesday | Company results

- Revenue increased by 62.2% YoY to RMB 2,701 million

- Gross profit surged by 82.2% YoY to RMB 975 million, with its margin of 36.1%

- Adjusted net profit before interest income and expense increased by 69.6% YoY to RMB 733 million, with its margin of 27.1%

- Adjusted net profit including interest income and expense increased by 50.1% YoY to RMB 801 million, with its margin of 29.6%

- Net profit grew by 52.7% YoY to RMB 746 million, with its margin of 27.6%

- The total global customer base expanded to 563, adding 64 new customers in 1H 2025

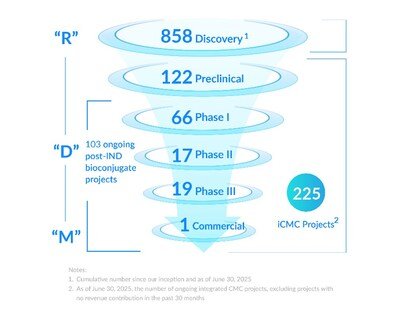

- The total number of iCMC projects reached 225, with 37 newly signed iCMC projects in 1H 2025

- The total backlog grew to US$1,329 million, representing a 57.9% YoY growth

- DP3 facility at the Wuxi site achieved GMP release, further enhanced All-in-One manufacturing capability

- Singapore site achieved mechanical completion of site construction and will achieve GMP release in 1H 2026

- Continue to invest in frontier technology and empower clients to explore and unlock frontier modalities, solidifying the Group's competitiveness and leadership position

- Multiple Top Awards from "2025 Asia (ex-Japan) Best Executive Team" by Extel (previously "Institutional Investor")

WuXi XDC Cayman Inc. (the "WuXi XDC" or the "Group", stock code: 2268.HK), a leading global Contract Research, Development, and Manufacturing Organization (CRDMO) focused on the bioconjugate market, is pleased to announce its interim results for the first half of 2025 (the "Reporting Period").

Dr. Jimmy Li, CEO of WuXi XDC, stated, "In the first half of 2025, WuXi XDC has once again exemplified the robustness of our integrated CRDMO model and the agility of our global teams. Amid a rapidly advancing bioconjugate landscape, we delivered record growth in project signing, expanded our customer base, and advanced our technology platforms and capacity expansion milestones. These achievements underscore our unwavering commitment to innovation, quality, and customer success. As we look to the future, we remain committed to high-quality execution with lean operation, investing in frontier technology, and empowering our clients to explore and unlock new modalities. We are confident in our ability to lead the next wave of bioconjugate breakthroughs and to continue delivering value to our customers and stakeholders."

Financial Highlights

- Revenue

The Group's revenue increased by 62.2% YoY to RMB 2,700.9 million for the six months ended June 30, 2025. This increase was primarily attributable to (i) the growth in the number of customers and projects, driven by continued active development of the global ADC and broader bioconjugates market, (ii) the increasing market share through the Group's established position as a leading ADC CRDMO service provider in that market, and (iii) the steady advancement of the Group's projects into later stages.

- Gross Profit and Its Margin

The Group's gross profit increased by 82.2% YoY to RMB 975.2 million, with a gross profit margin of 36.1% for the six months ended June 30, 2025, and a 4.0 percentage points increase compared to that of the corresponding period in 2024. This improvement is driven by (i) the enhanced overall operation and manufacturing efficiency, (ii) the utilization ratio of its production facilities continued to improve, and (iii) the faster ramp-up of the production line (BCM2 L2).

- Adjusted Net Profit Before Interest Income and Expense and Its Margin

The Group's adjusted net profit before interest income and expense increased by 69.6% YoY to RMB 732.6 million. The margin of adjusted net profit before interest income and expense improved to 27.1% for the six months ended June 30, 2025, a 1.2 percentage points increase compared to that of the corresponding period in 2024.

- Adjusted Net Profit Including Interest Income and Expense and Its Margin

The Group's adjusted net profit including interest income and expense increased by 50.1% YoY to RMB 800.8 million. The margin of adjusted net profit including interest income and expense is 29.6% for the six months ended June 30, 2025.

- Net Profit and Its Margin

The Group's net profit increased by 52.7% YoY to RMB 745.7 million. The significant growth in the Group's net profit during the Reporting Period is generally in line with the Group's revenue and business growth (after taking into account the effects of non-cash share-based compensation). The net profit margin of the Group is 27.6% for the six months ended June 30, 2025.

Customers and Projects Highlights

- We have continuously expanded our customer base, reaching a cumulative total of 563, through strong customer-enabling empowerment. Notably, 13 out of the top 20 global pharmaceutical companies (*ranked by 2024 revenue) have partnered with us in various stages of projects.

- From January to July 2025, 75% of acquired ADC companies in M&A transactions are our customers. Additionally, our customers captured more than 75 %[1] of the total deal value in licensing deals (*deal size exceeding USD 1 billion) over the same period. These metrics underscore our unmatched ability to accelerate customer growth and catalyze transformative global partnerships.

- The "Enable, Follow, and Win the Molecule" strategy continued to drive sustained and rapid project growth. The total number of integrated CMC projects ("iCMC projects") is 225, with 37 newly signed integrated projects in 1H 2025, hitting a new high record. The Group has successfully secured 11 PPQ projects and 1 commercial stage project.

|

[1] For companies that do not have im-house CDMO capabilities and to use third party to manufacture it's ADC. |

- The newly signed 37 iCMC projects showcased highly differentiated targets and innovative modalities, aligning with global bioconjugate innovation momentum. This strategic achievement not only signifies our successful capture of the current trend but also firmly establishes a robust foundation for future business growth.

- The Group has a diversified project base covering both innovative ADC and broader bioconjugate ("XDC") projects. The total number of integrated ADC projects reached 201, and the number of integrated XDC projects increased to 24.

- The Group is committed to pioneering the development of the bioconjugate industry and meeting various development requirements from our customers. In the first half of 2025, the Group generated over 2,300 conjugate molecules of multiple modalities, including bispecific ADCs, dual-payload ADCs, degrader-antibody conjugates (DAC), antibody-oligonucleotide conjugates (AOC), antibody-peptide conjugates (APC), antibody chelator conjugates (ACC), etc.

Fully Integrated R&D Technology Platform

- The Group strives to empower customers with cutting-edge conjugation and payload-linker technologies, along with extensive expertise in bioconjugate development capabilities to fulfill diverse R&D requirements.

- Conjugation Technology—The proprietary WuXiDARx™ technology aims to meet customers' demands for highly homogeneous ADCs with a range of clinically validated and distinct DAR values. An increasing number of novel modalities (AOC, APC, and dual-payload ADC) are being developed by using our WuXiDARx™ technology. The proprietary X-LinC technology can significantly improve plasma stability by replacing the maleimide connector, thereby potentially enhancing ADC stability and therapeutic window.

- Linker-payload technology—The Group is developing its proprietary Camptothecin(CPT) payload and hydrophilic linker to enable ADCs with better stability, hydrophilicity, and tolerability. The newly launched WuXiTecan-1 and WuXiTecan-2 demonstrated excellent efficacy and safety profiles (in mice and monkeys), with potential collaboration under discussion.

- By leveraging a diverse suite of in-house technology, extensive expertise, and collaborations with third parties, the Group maintains a leading position in the innovation of novel modalities by empowering customers to conduct differentiated and diverse R&D activities, with a focus on exploring cutting-edge areas such as bispecific ADCs, dual-payload ADCs, DAC, AOC, APC, etc.

Capacity Expansion and Business Operation Updates

- The total number of full-time employees increased by 51.7% YoY to 2,270 in the Group, driven by rapid business growth and the Group's capacity expansion.

- The Group has adopted a centralized quality assurance system across its All-in-One manufacturing facilities in the Wuxi site to safeguard product quality. During the reporting period, the Group maintained a high execution standard and delivered a 100% success rate to global customers. Notably, there are 4 PPQ component campaigns executed in 1H 2025.

- All the Group's manufacturing operations are conducted in accordance with the GMP regulations set by the FDA, EMA, and NMPA. The Group has completed more than 160 GMP audits from global customers, including 16 audits by EU Qualified Persons.

- Singapore site achieved the milestone of mechanical completion in June 2025 and has officially moved into the facility C&Q (Commissioning and Qualification) stage. The Singapore site is expected to achieve Good Manufacturing Practice (GMP) release in 1H 2026.

- With the GMP release of DP3 facility ("DP3") in July 2025, the Wuxi site has further increased its integrated manufacturing capacities. The DP5 facility ("DP5") is currently under construction and scheduled to achieve GMP release in 2027. The BCM2 L2 has been swiftly ramped up since its official launch in November 2024.

- The Group received multiple awards from the 2025 Extel (previously "Institutional Investor") ranking in diverse categories, signifying our commitment to corporate governance and high-quality investor interactions.

Key Financials

(for the six months ended June 30)

|

Key Financials (RMB Mn) |

1H 2025 |

1H 2024 |

YoY% |

|

Revenue |

2,700.9 |

1,665.2 |

62.2 % |

|

Gross Profit Margin (%) |

975.2 36.1% |

535.3 32.1% |

82.2 % |

|

Adjusted Net Profit Before Interest Income and Expense Margin (%) |

732.6 27.1% |

432.0 25.9% |

69.6 % |

|

Adjusted Net Profit Including Interest Income and Expense Margin (%) |

800.8 29.6% |

533.6 32.0% |

50.1 % |

|

Net Profit Margin (%) |

745.7 27.6% |

488.2 29.3% |

52.7 %a |

Most Read

- How Does GLP-1 Work?

- Innovations In Magnetic Resonance Imaging Introduced By United Imaging

- Management of Relapsed/Refractory Multiple Myeloma

- 2025 Drug Approvals, Decoded: What Every Biopharma Leader Needs to Know

- BioPharma Manufacturing Resilience: Lessons From Capacity Expansion and Supply Chain Resets from 2025

- APAC Biopharma Review 2025: Innovation, Investment, and Influence on the Global Stage

- Top 25 Biotech Innovations Redefining Health And Planet In 2025

- The New AI Gold Rush: Western Pharma’s Billion-Dollar Bet on Chinese Biotech

- Single-Use Systems Are Rewiring Biopharma Manufacturing

- The State of Biotech and Life Science Jobs in Asia Pacific – 2025

- Asia-Pacific Leads the Charge: Latest Global BioSupplier Technologies of 2025

- Invisible Threats, Visible Risks: How the Nitrosamine Crisis Reshaped Asia’s Pharmaceutical Quality Landscape

Bio Jobs

- Sanofi Turns The Page As Belén Garijo Steps In And Paul Hudson Steps Out

- Global Survey Reveals Nearly 40% of Employees Facing Fertility Challenges Consider Leaving Their Jobs

- BioMed X and AbbVie Begin Global Search for Bold Neuroscience Talent To Decode the Biology of Anhedonia

- Thermo Fisher Expands Bengaluru R&D Centre to Advance Antibody Innovation and Strengthen India’s Life Sciences Ecosystem

- Accord Plasma (Intas Group) Acquires Prothya Biosolutions to Expand Global Plasma Capabilities

- ACG Announces $200 Million Investment to Establish First U.S. Capsule Manufacturing Facility in Atlanta

- AstraZeneca Invests $4.5 Billion to Build Advanced Manufacturing Facility in Virginia, Expanding U.S. Medicine Production

News