Asia-Pacific Takes the Lead in Global Biopharma Resilience: Cytiva’s 2025 Index Highlights Regional Rise Amid Global Slowdown

08 October 2025 | Wednesday | Analysis

The 2025 Global Biopharma Index released by Cytiva, a Danaher company, reveals that while the global biopharma ecosystem has experienced a modest decline in overall performance, Asia-Pacific nations are redefining resilience through collaboration, innovation, and digital transformation.

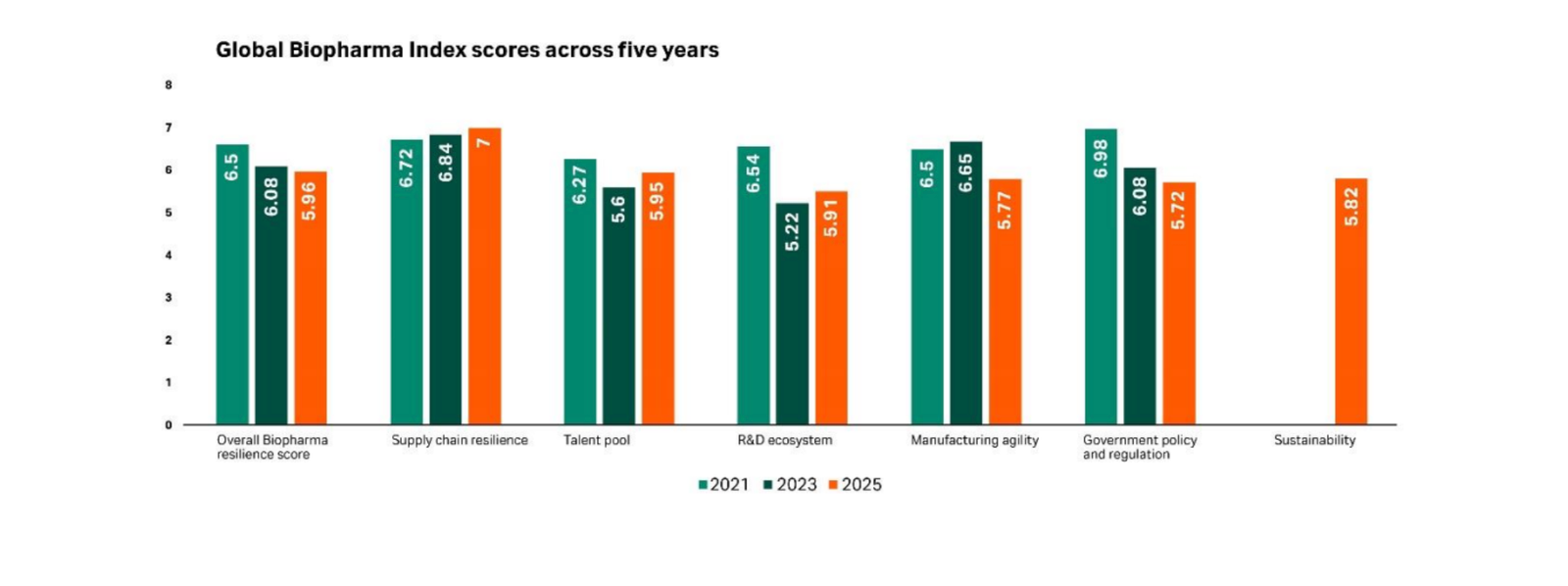

The biennial Index tracks the performance of 22 countries across six key pillars — supply chain resilience, talent pool, R&D ecosystem, manufacturing agility, government policy and regulation, and sustainability. Based on responses from 1,250 biopharma executives, this year’s global average fell to 5.96, down from 6.08 in 2023 and 6.60 in 2021, signalling growing regulatory and talent strain across mature markets.

Yet, Asia-Pacific continues its upward climb.

-

South Korea vaulted from 12th to 3rd, thanks to strong digital innovation, expanded clinical trial infrastructure, and high R&D productivity.

-

Singapore (6th) remains a model of government–industry collaboration and agile policymaking.

-

Japan (7th) continues to narrow its innovation gap through public–private coordination.

-

India, now in the top 10, reflects its growing strength in R&D, generics, and manufacturing scalability.

-

Thailand (17th) also showed notable progress in supply chain modernisation and workforce readiness.

“Continued evolution and collaboration between government agencies and industry partners are essential to ensuring the biopharma industry can meet global demands,” said Pierre-Alain Ruffieux, Chief Operating Officer, Cytiva.

Global Context: A Widening Gap Between Leaders and Laggards

While Switzerland, the United Kingdom, and South Korea dominate the 2025 Index, the report notes that the gap between high-performing and struggling nations is widening.

Economic strength is no longer a reliable predictor of biopharma resilience. Instead, upper-middle-income economies that prioritise advanced manufacturing, regulatory reform, and innovation incentives are catching up rapidly.

“The world is shifting from globalisation to more regional perspectives,” observed Michael May, President and CEO of the Centre for Commercialization of Regenerative Medicine (CCRM). “To bring sophisticated products to market, we must be as collaborative as we’ve ever been.”

Key Insights from the Six Pillars of Resilience

-

Supply Chain Resilience:

55% of executives believe their country’s supply chains are stronger than a year ago. Yet, one in four say they’re still unprepared for advanced modalities like cell and gene therapies.

76% expect geopolitical volatility to reshape sourcing strategies, and over half foresee a surge in domestic biologics manufacturing within three years. -

Talent Pool:

Despite slight improvement, critical shortages persist — particularly in manufacturing, digital, AI, and sustainability roles. Around one-third of respondents report severe skill deficits affecting production and innovation readiness. -

R&D Ecosystem:

Collaboration remains a bottleneck. Nearly half of global executives find it difficult to secure high-quality research partners such as CROs/CDMOs, universities, or government labs — a challenge APAC nations are addressing through coordinated innovation hubs. -

Manufacturing Agility:

One in four companies admitted limited ability to scale production rapidly, especially for mRNA, hormone-based, and cell therapy products — exposing a gap between innovation potential and operational readiness. -

Government Policy & Regulation:

Fragmented and unpredictable policies continue to frustrate industry players. 51% of respondents report inconsistency in policy frameworks, while half cite difficulty raising capital due to volatile market conditions. -

Sustainability:

Nearly half of executives say their firms are missing sustainability targets, with two-thirds deprioritising ESG goals under financial pressure. Notably, 34% identified sustainability-specific talent shortages as a barrier to progress.

APAC’s Defining Moment

From Seoul to Singapore, the Index underscores that Asia-Pacific’s success lies not in scale, but in synergy — an alignment between policy, technology, and people. Nations investing in skill-building, regulatory harmonisation, and digital manufacturing are now setting global benchmarks for efficiency and adaptability.

As Cytiva’s Index reveals, resilience is no longer a solo pursuit — it’s an ecosystem achievement. And in 2025, the Asia-Pacific region stands as the proving ground for what the next generation of biopharma excellence looks like.

Most Read

- How Does GLP-1 Work?

- Innovations In Magnetic Resonance Imaging Introduced By United Imaging

- Management of Relapsed/Refractory Multiple Myeloma

- 2025 Drug Approvals, Decoded: What Every Biopharma Leader Needs to Know

- BioPharma Manufacturing Resilience: Lessons From Capacity Expansion and Supply Chain Resets from 2025

- APAC Biopharma Review 2025: Innovation, Investment, and Influence on the Global Stage

- Top 25 Biotech Innovations Redefining Health And Planet In 2025

- The New AI Gold Rush: Western Pharma’s Billion-Dollar Bet on Chinese Biotech

- Single-Use Systems Are Rewiring Biopharma Manufacturing

- The State of Biotech and Life Science Jobs in Asia Pacific – 2025

- Asia-Pacific Leads the Charge: Latest Global BioSupplier Technologies of 2025

- Invisible Threats, Visible Risks: How the Nitrosamine Crisis Reshaped Asia’s Pharmaceutical Quality Landscape

Bio Jobs

- Sanofi Turns The Page As Belén Garijo Steps In And Paul Hudson Steps Out

- Global Survey Reveals Nearly 40% of Employees Facing Fertility Challenges Consider Leaving Their Jobs

- BioMed X and AbbVie Begin Global Search for Bold Neuroscience Talent To Decode the Biology of Anhedonia

- Thermo Fisher Expands Bengaluru R&D Centre to Advance Antibody Innovation and Strengthen India’s Life Sciences Ecosystem

- Accord Plasma (Intas Group) Acquires Prothya Biosolutions to Expand Global Plasma Capabilities

- ACG Announces $200 Million Investment to Establish First U.S. Capsule Manufacturing Facility in Atlanta

- AstraZeneca Invests $4.5 Billion to Build Advanced Manufacturing Facility in Virginia, Expanding U.S. Medicine Production

News